By James D. Spellman, Strategic Communications LLC

Signs mount that China’s outlook is deteriorating, as a credit-driven bubble of irrational real estate prices bursts and decades of infrastructure investments to sustain double-digit growth have resulted in detrimental side effects, ushering in a likely recession. As the dominant market for many EU-made products, from luxury goods to machinery to transport equipment, China’s slowdown will have far-reaching consequences as Europe’s recovery remains fragile.

China matters to Europe in many ways, particularly as an outlet for Europe’s goods and services and as a sourcing region by European companies for producing low-cost products shipped to the EU. The European Union is China’s largest trading partner, and China is the second-largest trading partner of the EU after the United States.

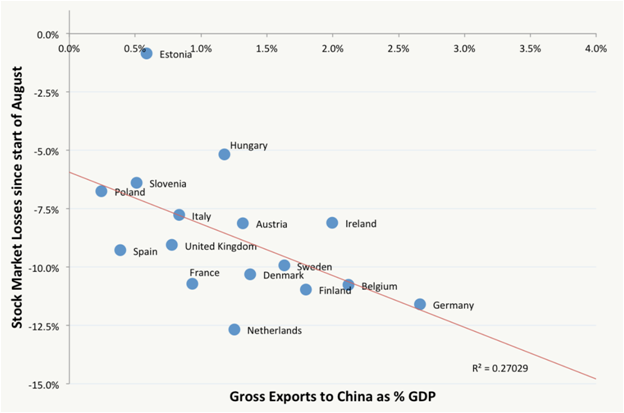

A large share of Germany’s total export growth, a 154-percent increase between 2000 and 2013, comes from its expansion in China’s markets, according to the Brussels-based think tank Bruegel. Germany contributes one-third of the total trade volume between China and Europe, according to EU statistics.

CHART: EU Countries’ Gross Exports to China as Percentage of GDP Source: Bruegel. http://bruegel.org/2015/08/china-stock-market/

Source: Bruegel. http://bruegel.org/2015/08/china-stock-market/

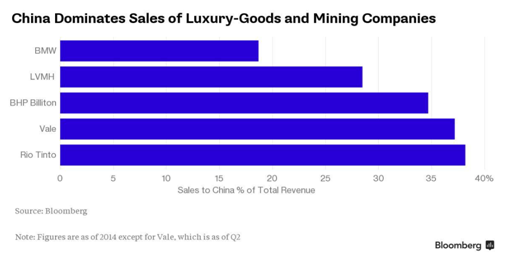

For the French luxury goods producer Hermès, between 20 and 25 percent of the company’s revenues come from China, according to Citibank. The UK banking groups Standard Chartered and HSBC also have deep ties to China. Several European companies, including Burberry, Swatch, and BMW, have issued profit warnings as their sales in China slow.

Source: Bloomberg, “More Losers than Winners in China Devaluation.” August 11, 2015. http://www.bloomberg.com/news/articles/2015-08-11/more-losers-than-winners-in-china-devaluation-as-bmw-lvmh-slump .

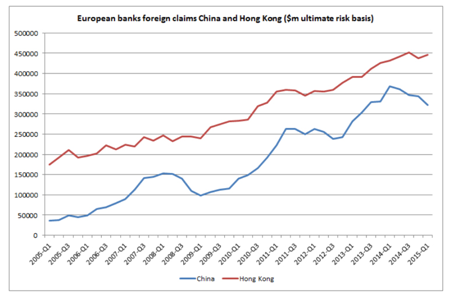

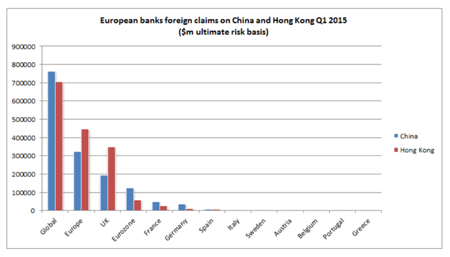

European banks’ exposure, though, has remained relatively small with China accounting for only 2.2 percent of European banks’ foreign claims and Hong Kong for 3 percent. A large percentage of this share is held by two of the UK’s largest banks – HSBC and Standard Chartered.[1]

CHART: EU-Based Banks’ Claims on China, Hong Kong, 2005 - 2015

CHART: European Banks’ Foreign Claims on China, Hong Kong, First Quarter 2015 Source: Raoul Ruparel, ”How Exposed Is Europe To A Chinese Economic Slowdown?” Forbes, August 25, 2015. http://www.forbes.com/sites/raoulruparel/2015/08/25/how-exposed-is-europe-to-a-chinese-economic-slowdown/

Source: Raoul Ruparel, ”How Exposed Is Europe To A Chinese Economic Slowdown?” Forbes, August 25, 2015. http://www.forbes.com/sites/raoulruparel/2015/08/25/how-exposed-is-europe-to-a-chinese-economic-slowdown/

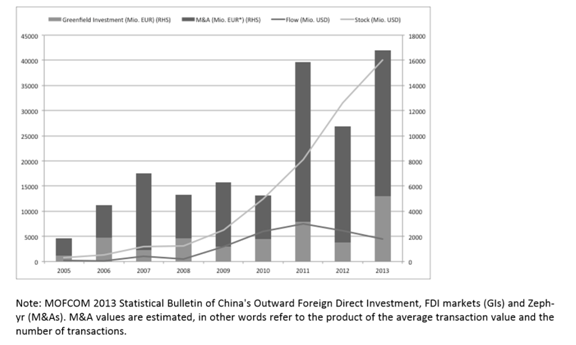

China’s direct investment in EU countries has also had an impact on the EU economy. Since the 2008 financial crisis, China diversified its bond portfolio to include European bonds. China’s direct investment, while about one percent of total foreign direct invest in Europe, has been increasing rapidly.

“The cumulative financial value of such investment projects increased from approximately US$750 million in 2005 to more than US$40 billion by the end of 2013,” according to researchers, citing statistics from China’s Ministry of Commerce. “The annual FDI inflow in the 2005–08 period was about US$450 million, compared to more than US$6 billion in the 2010–13 period. This represents a more than tenfold increase.”[2] France, the United Kingdom, and Germany attracted most of these investments.

CHART: Chinese OFDI in the EU Source: Christian Dreger, Yun Schüler-Zhou, and Margot Schüller, “Determinants of Chinese Direct Investments in the European Union.” May 1, 2015. DIW Berlin Discussion Paper No. 1480. Available at SSRN: http://ssrn.com/abstract=2605831 or http://dx.doi.org/10.2139/ssrn.2605831 .

Source: Christian Dreger, Yun Schüler-Zhou, and Margot Schüller, “Determinants of Chinese Direct Investments in the European Union.” May 1, 2015. DIW Berlin Discussion Paper No. 1480. Available at SSRN: http://ssrn.com/abstract=2605831 or http://dx.doi.org/10.2139/ssrn.2605831 .

CHART: China’s FDI in the EU 27 2000 – 2011 (in US$ million and number of deals) Source: Sophie Meunier, “ ‘Beggars can’t be Choosers’: The European Crisis and Chinese Direct Investment in the European Union.” Journal of European Integration, 36:3 (2014). Pages 283-302.

Source: Sophie Meunier, “ ‘Beggars can’t be Choosers’: The European Crisis and Chinese Direct Investment in the European Union.” Journal of European Integration, 36:3 (2014). Pages 283-302.

A scholar at Princeton’s Woodrow Wilson School, Sophie Meunier, argues that the sovereign debt crisis and recession provided Chinese investors with two bargains: “economic bargains due to depressed prices and a greater number of assets for sale, and political bargains due to the lessened political resistance to deals that may have been objectionable in flusher times.”[3]

In the coming months, the power of the European Central Bank’s quantitative easing program will be tested as a counterweight to the fallout from the slowdown in China. For Germany, with the most to lose in exports, the drop in China’s demand puts in doubt the country’s continued ability to be Europe’s locomotive, especially since other growth markets, the emerging markets countries, are suffering from a collapse in commodity prices and sharp currency devaluations.

[1] Raoul Ruparel, ”How Exposed Is Europe To A Chinese Economic Slowdown?” Forbes, August 25, 2015. http://www.forbes.com/sites/raoulruparel/2015/08/25/how-exposed-is-europe-to-a-chinese-economic-slowdown/

[2]Christian Dreger, Yun Schüler-Zhou, and Margot Schüller, “Determinants of Chinese Direct Investments in the European Union.” May 1, 2015. DIW Berlin Discussion Paper No. 1480. http://ssrn.com/abstract=2605831 or http://dx.doi.org/10.2139/ssrn.2605831 .

[3] Sophie Meunier, “ ‘Beggars can’t be Choosers’: The European Crisis and Chinese Direct Investment in the European Union.” Journal of European Integration, 36:3 (2014). Pages 283-302.